Student loan income based repayment calculator navient

The remaining balance monthly payment and. Your new monthly payment will be dependent on factors such as income.

Pin On Information

Federal student loan borrowers pay a percentage of their discretionary income 10 15 or 20 depending on the specific income-driven repayment plan you choose.

. If you choose the IBR plan your monthly student loan payment would be 149 which is 406 lower than your current monthly payment. Student Loan Repayment Calculator. Payments are capped at 10 of discretionary income if you received loan money after July 1 2014 and 15 if you received loan money before then.

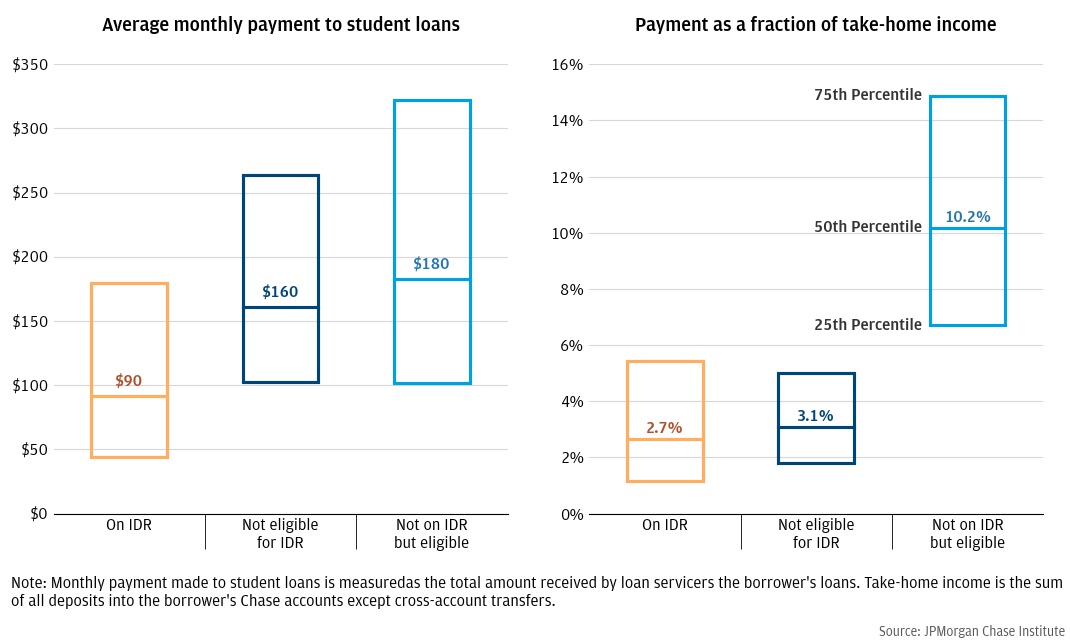

All income-driven repayment plans are. Switching to IBR would lower your current monthly student loan payment to 183 which is 213 lower than your current payment. Income-Driven Repayment IDR plans can cap your required monthly payments in proportion to your discretionary income.

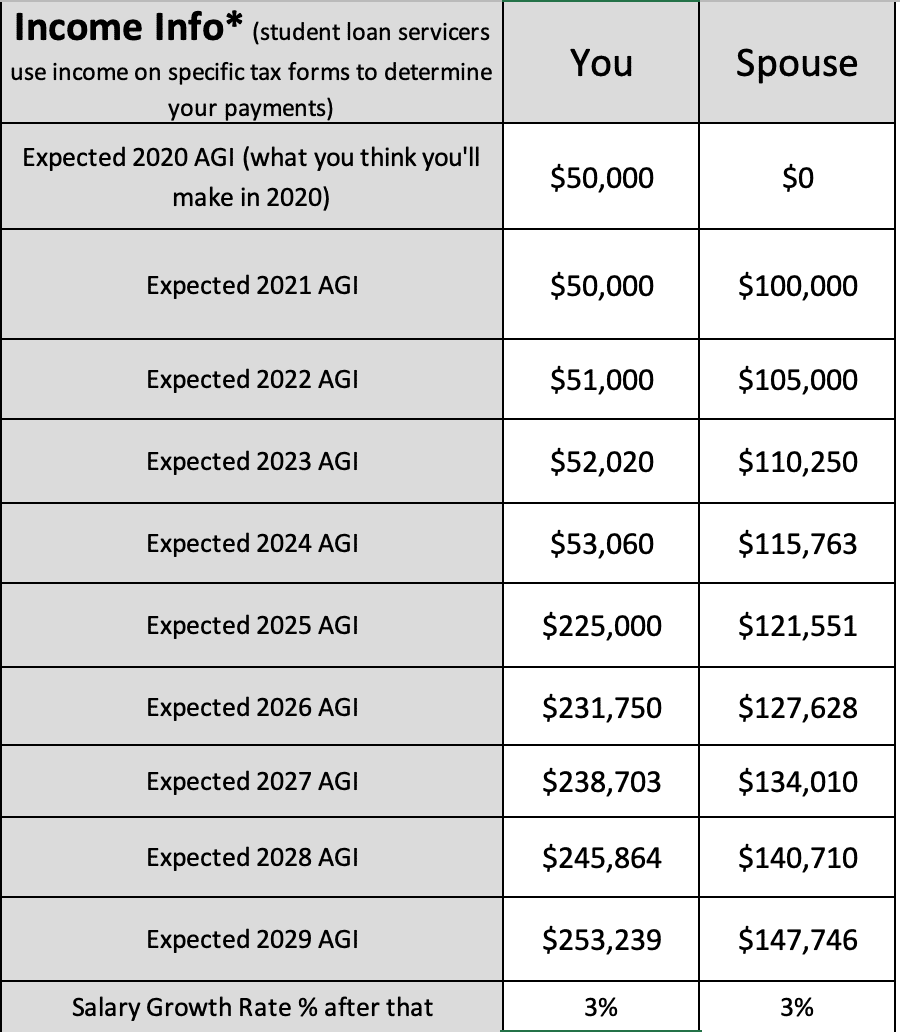

Calculate your combined federal student loan debt. Your 30000 plus your spouses 50000 is 80000. This student loan payment calculator will provide you results on what your income-driven payment should be for your federal student loans.

Under income-driven repayment options payments are set as a percentage of discretionary income the difference between your adjusted gross income and the poverty guideline for your. They are a great option. Investment Management by Principal.

With an annual income. Managing nearly 300 billion in student loans for more than 12 million debtors. Income-Driven Repayment IDR Calculator.

If you have parent. Navient launches new student loan calculator to help borrowers plan for faster loan repayment Mar 9 2016 WILMINGTON Del March 09 2016 GLOBE NEWSWIRE --. If you are already enrolled in an IDR plan you must recertify your income each year to remain in the plan.

Monthly Payments under the. Find the percentage of the debt you owe. Limits your payments to 10 of discretionary income and never more than the 10-year Standard payment amount Forgiveness after 20 years of payments.

With our free income-based repayment plan calculator you can see if you are eligible for a lower monthly payment. Navient is an American corporation based in Wilmington Delaware that services and collects student loans. Use the application below to apply now or to recertify your plan.

Ad Estimate College Education Expenses With Scholars Edge 529 Plan Calculators. Use the calculator below to evaluate the student loan payoff options as well as the interest to be saved. This plan has a repayment schedule with fixed Monthly Payment Amounts of principal and interest that will be due for the repayment term.

You are eligible for loan.

/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

Subsidized Vs Unsubsidized Student Loans Which Is Best

Income Based Repayment Of Student Loans Plan Eligibility

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

:max_bytes(150000):strip_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Private Vs Federal College Loans What S The Difference

What The Navient Lawsuit Means For Your Student Loans Part 3 Student Loan Repayment Student Loans Student Loan Forgiveness

107 Ways To Pay Off Your Student Loans Student Loan Planner

How Income Based Repayment Is Calculated If Your Income Changed Student Loan Planner

Which Is The Best Income Driven Repayment Plan For Your Student Loans Student Loan Hero

Pin On Money

Income Based Repayment Ibr Calculator Lendedu

Ibr Vs Icr How To Choose The Right Repayment Plan Student Loan Hero

Income Driven Repayment Who Needs Student Loan Payment Relief

Free Calculators To Do Your Student Loan Forgiveness Math For You Student Loan Hero

Pros And Cons Of Income Driven Repayment Plans For Student Loans

How To Lower Student Loan Payments Credible

Income Based Repayment Calculator Includes Biden Ibr Plan

Can I Get A Student Loan Tax Deduction The Turbotax Blog